Time for another debt snowball update.

Time for another debt snowball update.

But first.

Part of my choice to write & publish in such a public sphere, I put myself, my family, up for scrutiny.

At times I cringe, & think–what am I thinking, sharing such details with all the world?!

But then other times, particularly after I receive a sincere & heartfelt email from a reader about how reading bring joy has helped them some way, I move forward with confidence & know that by sharing, I am doing some good.

I’m in a very trying period of my life right now. Forgive me if my next slew of thoughts are a bit jumbled.

I feel like I’m being pushed & pulled, knocked down & humbled by this mothering thing. It’s not just motherhood. If only it were that! It’s being a military spouse, where my husband often has to work very long hours (with no overtime), goes to training in another state for weeks at a time (he’s been gone for pretty much the better part of this last month), & I’m left to care for all the details of child rearing, housekeeping, & our finances.

To say it’s a piece of cake, though I’m quite capable of this type of responsibility, would be a lie.

Fortunately, though Joseph’s income is not substantial, he is an officer in the military, so his pay is decent (though quite a cut below his civilian peers). And with his job comes many other benefits besides pay–housing & food stipends, full medical insurance, subsidized life & dental insurance, help with student loan repayment. So despite the struggles, we are blessed, and more than just in a financial sense.

But there is still a part of me all the blessings & struggles aside, a strong & vocal part of me that cannot keep quiet the “GET OUT OF DEBT,” voice that nudges me, almost incessantly.

Friends, readers of this blog, & others have suggested in various ways: “Debt is no big deal–it’s just an opportunity cost.”

I’m here to tell you, for this thirty-something mother of five, who has no savings, no retirement to speak of, & still (what seems like) a mountain of debt. IT’S A FREAKIN’ BIG DEAL.

Because each day that goes by that I have debt, is a day that goes by that I’m not saving. Not saving for that tsunami of expenses that are sure to come in five or ten years & beyond, as my children hit their teen & young adult years & the expenses mount & snowball.

And that is absolutely a big deal.

I’m sharing this as a precursor to our debt update. Hopefully to give you some context for where I’m at, where our family is at as we move forward. I could just post some numbers of our debts, but that would only tell a fraction of the story.

And the story is, we’re getting close! Yes it’s hard. And yes, it’s less than fun to make hard choices (especially the delaying gratification ones), but as I write this, the excitement at the prospect of being so close to reaching our debt-free goal, is shooting out my fingertips & into my keyboard.

Since we began this journey almost two years ago, I have become more & more frugal.

Through trial & error I’ve learned I can live on less. That my children can live on less. And that we can absolutely be happier & the better for it.

This paradigm shift has been gradual, but a few things of late have really added more fuel to the get-out-of-debt fire.

Reading MMM has helped my thinking (especially in regards to debt, frugality, & saving) in a totally new way. Reading this post about debt was also another good kick in the rear.

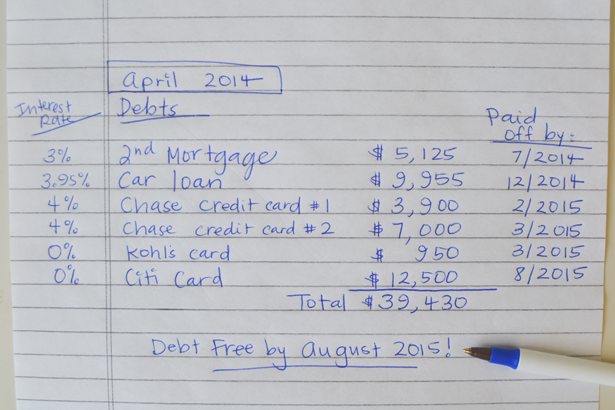

Here’s my last update from April 2014:

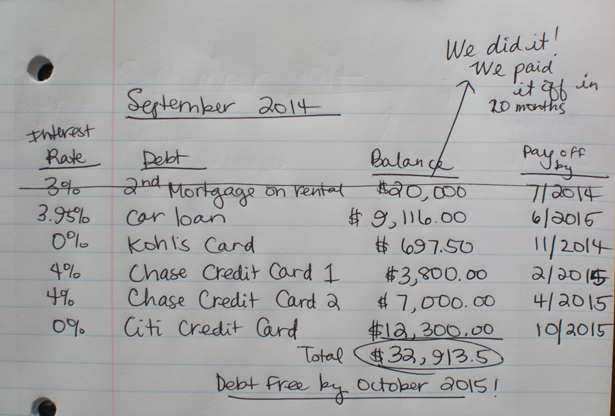

Since the last update, we DID pay off the 2nd mortgage on our rental home.

The rest of the debts are fairly unchanged, though the order in which we will pay them off has been switched up–namely, we’re going to pay off the small balance on the Kohl’s card (even though it’s 0% interest) before the others.

Notice how our month to be debt-free has been pushed further into the future than before. This is because we’re working on creating a buffer (see change/tweeks below).

Not on the list are our student loans, which except for one (which we have to make a $450 payment to each month), are all covered under two different government & military student loan repayment programs & doesn’t require us to make any payments.

Also, I explain why we have so much credit card debt in this post.

A few other changes/tweeks:

- We’re now using YNAB software & principles to budget.

This program is amazing! I’ve just begun to use the software & apps but already I know this is exactly what the budgeting doctor ordered. I plan on doing a full review of the software sometime in the next few months. - We’re building a buffer.

We’re holding off making any extra payments above our base debt payments & putting that money into our “buffer” fund, which is part of YNAB rule #4. Essentially, we’re saving one month’s worth of income to just sit in our checking account so that we can start living on last month’s income, instead of this month’s income. One month’s income, including our rental income, is roughly $7,000. Our goal is to have our buffer complete by end of November. This has set us back on our debt snowball progress by a few months, but it will mean greater financial security & peace now & in the long run.

→ Try a FREE 34-day full trial of YNAB (affiliate link)

& for bring joy readers–get 10% off your purchase if you decide to buy it!

- We’re also rebuilding our $1,000 emergency fund.

We had various expenses come up over the past year which have depleted our emergency fund which is currently $0. I have to be honest, I haven’t been very good at keeping an emergency fund, & once we get it to $1,000, we’re going to do much better at keeping it there.

Also, you may notice that in addition to creating a buffer & emergency fund, we’ll be paying off nearly $33K in the next year or so, which is more than what we’ve paid towards debt in the last two years combined. This is because: 1) we’re making more money & 2) we’re cutting our expenses even more.

- Joseph got a raise! Nearly $600 extra a month. Though some of that goes to taxes & tithing.

- Blog revenue. I’m finally making some money from bring joy, thanks to taking this course (affiliate link) from my pal Bonnie Andrews. Since I’ve taken the course in March, I’ve earned a few thousand dollars in revenue, which has averaged out to several hundred dollars extra a month.

- I’m teaching preschool. Just once a week, out of my home. I only have six students (including my 3 year old, Salem), but, not only do I not pay for preschool, but I earn about $200 a month too. Win-win.

- I’m hustlin’. I do freelance work–a lot of it’s one-time random stuff (I just took pictures for a family & got paid $500), some of it’s more short-term temp stuff (like editing). This is income that I absolutely can’t bank on, but I’ve been fairly consistent in getting freelance work here & there, which helps out a lot & adds up.

- Selling stuff on eBay. I’m still continuing to sell things we don’t need or use, on eBay. Big or little, it adds up.

- Increase in rents for rental property. We increased the monthly rent on our rental property by a few hundred bucks to more accurately reflect the value & market demand.

- We’re cutting all frills, lowering expenses–even more. Like dance lessons for Mali, cell phones (we only pay $20/month for our phones & have been doing this since the beginning of the year), & continuing to do things like line drying our laundry, cloth diapering, & saving on gas by only making trips (beyond Joseph going to work) a few times a week.

- Rice & beans. Yup, after several months over the summer, I’ve worked out a workable solution to the grocery budget (you know how I’ve gone back & forth on this issue). And it’s this–we do a lot of repetition of really frugal dishes, cut out any extra luxury items (like my fave protein powder & pure maple syrup!) & stick to very basic, basic stuff like oatmeal, rice (despite the arsenic 🙂 ), homemade wheat bread (for my family, not for me unfortunately because though I love the stuff, you know I can’t tolerate the wheat), beans, pasta, soy/almond milk, & in-season low cost fruits & vegetables.

You add the extra income, plus the cuts, & we’re able to throw about $3,000 a month towards our debt (& we’re still paying tithing), instead of the $1,200-$1,800 a month we were doing before.

Pretty exciting, don’t you think?

Other bring joy posts you might want to check out:

Comments