It’s been awhile since I gave an update on how our debt snowball is going.

But first, can I show you some pictures of my latest crush?

Tyndale is almost 3 months.

If you’re wondering what I do all day, the answer is: Yes, I gaze into those blue, blue eyes. Yes, I hold Tyndale every second I can get & kiss his fat checks. Yes, I adore this little man.

I’ve had four babies before, but this has to be the funnest I’ve ever had with a baby. If he’s slept for too long, I get kinda sad & want him to wake up just so I can smile & coo & cuddle with him. He is the sweetest, most chill baby I’ve had. We all love him. So much.

About that debt.

We’re about half way through our good-riddance-debt process. It all began about October 2012 when Joseph got his first real paycheck, from his hard earned real, *grown-up* career post law school.

In the 18 months since then, we’ve paid a lot towards our debts–somewhere around $26K, but not nearly the amount I would have liked.

The good news is, we’ve had additional money come our way, so yes, it’s a let down we haven’t bulldozed through as planned, but we have made great strides. Progress, though not perfect, is to be celebrated.

What have I learned since we’ve started?

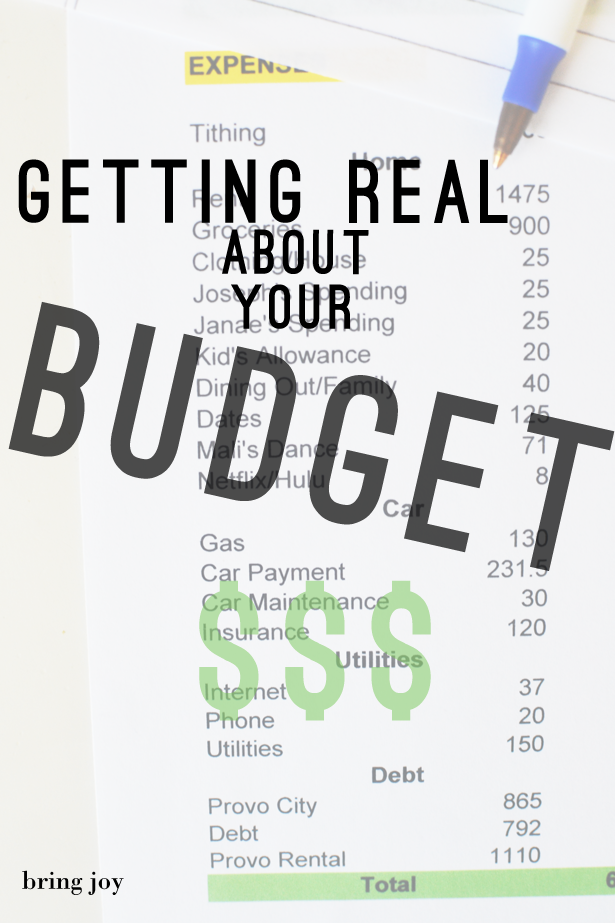

Mainly, I need to strike a balance between ambitions & reality. Especially with things like the grocery budget. I thought we could be consistently below $500 a month. Maybe a stronger person than I could do that, but Joseph & I agreed recently that $900 was not only realistic, but totally do-able.

I also realized I don’t like have a separate household budget. So groceries count food & any household items, including birthday gifts for that month.

And Christmas! Boy, as much as I like the *idea* of a minimal Christmas, the truth is, in practice, I LOVE giving gifts! So, a reasonable Christmas budget for our family of 7 is $1,000. This includes a lot of necessities like clothes & shoes.

Another thing that I hadn’t budgeted for is back to school shopping. I did all of my shopping this last year at Goodwill & the clearance rack at the Gap Outlet & still spent a little over $300.

More “unexpected” expenses:

1. A trip to Washington for a family reunion last summer. Gas & food for 5 weeks away from home turned out to be much more than anticipated. We spent about $2K on the trip.

Note to self: traveling is *always* more expensive than you anticipate, so plan accordingly.

2. Pregnancy. Though we didn’t have to pay a cent for medical bills (one of the perks of military life), we did spend about $1,000 more than usual during my first trimester on food. Because, as you know, during that nauseating time I can’t cook & all I want to eat is crap. (It’s true.)

2. Car repairs. Our car door fell off. $350 to fix.

3. Joseph got a traffic ticket. $200.

4. Lawn mower broke. Need a new, used one. Hope to get one on craigslist for under $50.

And then there are yearly expenses like eye exams & contacts, & car registration & licensing fees, which run around $400 total. I figured all of these yearly incidentals for now, will be paid every year around March, when we get our tax return.

It’s really important to review your budget & your debt snowball every few months & make needed adjustments to reality. It’s a lot better to live honestly about your needs (& wants), rather than to have crazy unrealistic ambitions that aren’t sustainable (like my crazy idea to just live on rice & beans!).

About the student loans…

This past month, aside from getting a larger than anticipated tax return (which went mostly towards debt–yay!), our AF loan repayment payments went through, which means, we no longer have to make payments towards our student loans, freeing up more money to go towards other debt.

It’s a three year process & they only pay a chunk on your loans once a year. But over the course of three years they pay $65K (a big reason why we decided to go with the AF) which covers most of our student loans.

The rest is covered under the public servant loan repayment program which is income based, & based on our family size & income, we currently don’t have to pay anything each month. This is another reason we choose the AF.

Between the two programs, we don’t have to worry about student loans for another two years, at which point we’ll have to pay off the remaining balances (somewhere around $4K) that wasn’t covered under the AF loan repayment plan.

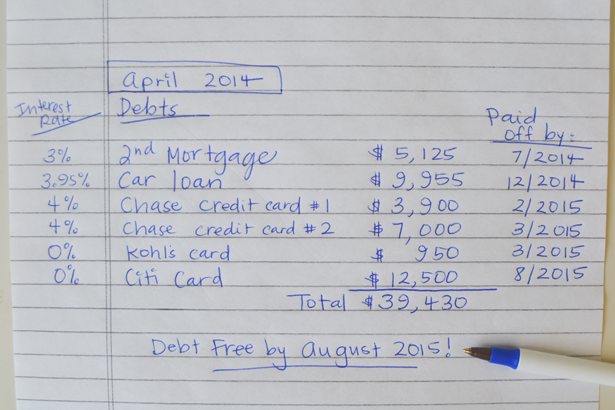

Here’s a breakdown of the rest of our debt:

I have to say the reason why we have so much credit card debt is because for nearly a year & a half between Joseph’s law school graduation & him actually starting his career as a JAG, we lived on our credit cards. I worked (actually had a great job, but it was only part-time) & Joseph was a stay-at-home dad & studied for the bar exam (he had to take it twice). It was rough having to live essentially on credit cards, but it got us through, & for that we’re thankful.

Our interest rates for our credit cards are so low because they’re covered under SCRA for military members. Essentially, all credit cards opened up before military service are covered under SCRA, which means credit card companies have to lower the interest rate below 6%. Chase lowered ours to 4%, Kohl’s & Citi to 0%. The rates are good for as long as we’re in the service. Nice perk, for sure!

So, we’ve adjusted our budget as well as our debt snowball to reflect reality as well as an increase in income that we’ll get in August due to an increase in rents (from our rental property) + a raise for Joseph. Though we’re still living on essentially one income, I’ve begun bringing in some revenue from bring joy, which is awesome, but I’m not counting this as reliable income (yet). Anything I make will automatically go towards debt & will just be icing on the cake. Hopefully that income will help us get out of debt that much sooner. For now, the projected debt-free (not counting the mortgage on our rental property or the remaining balances on our student loans, which we don’t have to worry about–see above) date is August 2015. The original goal was January 2015, or thereabouts, but as long as we get there sometime in 2015, I’ll be happy.

Our first big loan will be paid off this August, followed by our car in December, if all goes as planned. It’s really exciting to see those numbers go down each month.

If you have a mountain of debt before you, there is hope.

Keep your eye on the prize, which is a debt-free life, & believe that that debt-free day will come. With intense focus on the ultimate goal, you can achieve it. I know this, because we’re doing it–slowly but surely, we’re getting there. And this is exciting.

Out of debt: 5 steps

Should you continue to tithe when getting out of debt?

What to do about kid’s extra-curriculars when getting out of debt?

Distinguishing between needs & wants

♥

What’s your experience with reality & budgets?

Do you stick to a budget every month or is it more of a nice ideal for you?

What things do you do to help you stick with your budget?

Are you on the get-out-of-debt-boat too?

Please share!

Thanks for coming to bring joy today!

Did you know I’m also on twitter, pinterest, & facebook?

You can follow the blog via feedly or subscribe via your fave blog reader.

Have a question for me, or just want to say hello,

send me an email.

Pingback: how to create an abundance mindset {no matter your income} | bring joy