Read part 2, here.

I have been stewing about this post for sometime.

I mean, who wants to bear their financial soul to the world?

(Not me.)

But you know, I share this update with the intent to be honest, to be real with you. I know how much it sucks to have to pull yourself out of debt, even in the best of circumstances. I know how lame it feels to see those numbers, & realize what the cost will be to make them (eventually) go away.

Forgive me if I may be sharing too much detail, & for all I know this all may be very dull to you. But know that I share this with the very sincere hope that this will be helpful & informative, especially if you happen to be like us, & are digging yourself out of debts.

It has been 3 years since this post, meaning 3 years since we began working towards being debt-free.

I laugh when I read that post.

The tone is a touch naive & not entirely grounded in reality (so I have found out in subsequent years). But, I wouldn’t expect anything less from myself. I have a tendency to shoot for, not the moon, but for Jupiter, or Pluto (which we all know why that’s a bad idea). I won’t rehash my overly optimistic goals here (you can read them here), but I will say that some of our goals have changed.

(And for all the die hard Dave Ramsey fans wanting to know why we’re not doing the Dave Ramsey plan, read my post on Why John McDougall & Dave Ramsey are alike.)

We still want to get out of debt of course, but we’ve had to temper that desire with the reality that our family has other needs as well as wants too, & those things can’t be completely ignored or neglected without some serious consequences.

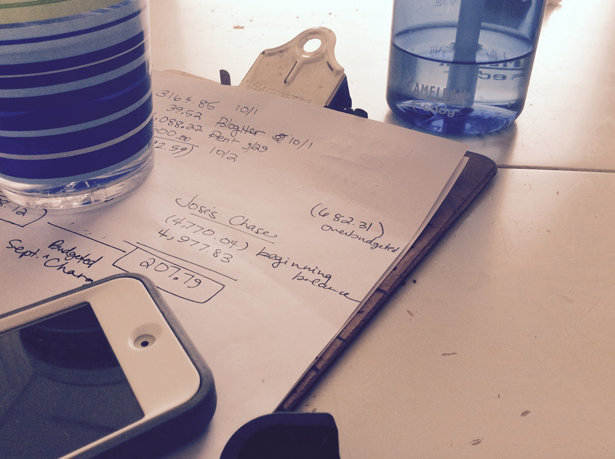

You may remember that about a year ago I shared that I had discovered YNAB*.

After doing their free trial & attending several of their free, online live classes (that were super helpful in getting me to learn to the YNAB ropes), I told them I loved their software & I wanted to share with my readers so they gave me the software for free (it’s $60 & the app is free, though you have to own the software to use the app).

I used YNAB for a few months, then sorta fell off the wagon, got back on for a month or two, then fell off for a month, got back on, then really fell off around the time we were getting ready to move overseas–pretty much from March-August of this year, our finances went to hell in a handbasket.

For anyone who has PSCed (military speak for moved), especially overseas, knows how stressful (financially & otherwise) it can be.

I vowed that as soon as we settled in Okinawa I would get things back on track & start using YNAB again. I have been using Mint throughout all of this, but it doesn’t give nearly the crystal clear financial awareness that YNAB does. Not to mention there are about a dozen reasons why I don’t like Mint–but that is for another day.

So I have been using YNAB for the past two months & I feel much better about life. The one thing YNAB has shown me about how we’ve been going about this get-out-of-debt thing, is that, I AM IN DENIAL!

One of the (many) things I love about YNAB is how it’s grounded in rock solid principles, while not being overly prescriptive. It’s a non-judgmental, we-are-all-adults-here, no-nonsense approach to financial management that totally resonates with me. It’s based on 4 rules:

- Give every $ a job.

- Save for a rainy day.

- Roll with the punches.

- Live on last month’s income.

We’ve been pretty good at rules 1 & 3, but lousy at 2 & 4.

About living in denial, see below for our debt snowball overview as well as the synopsis of the good, the bad, & the ugly (especially the bad & ugly sections).

*YNAB, or You Need A Budget. You should check it out. You can try a free 35 day trial, + take all sorts of really helpful FREE budgeting live courses (they offer several each day, & they’re all online). If you decide to buy, bring joy readers can get 10% using this (affiliate link) link.

Debt Snowball Overview 2012-2015

Let’s look at our progress over the past 3 years.

October 2012

- credit cards $18K

- consolidation loan $24K

- 2nd mortgage* $19K

- student loans $110K

- 1st mortgage** $139K

- Total $310K

March 2013

- credit cards $16K

- consolidation loan $22K

- auto loan*** $12K

- 2nd mortgage $15K

- student loans $109K

- 1st mortgage $138K

- Total $312K

April 2014

- credit cards $24.5K

- consolidation loan $14K

- auto loan $10K

- 2nd mortgage $5K

- student loans $90K

- 1st mortgage $131K

- Total $274.5K

October 2015

- credit cards $26K

- consolidation loan $8K

- auto loan $0 (paid off 7/2015)

- 2nd mortgage $0 (paid off 9/2014)

- student loans $75K

- 1st mortgage*** $123K

- Total $232K

*On our used-to-be-primary-residence turned rental property.

**We refinanced to a 15 year fixed mortgage @ 3.3% in April 2013.

***We bought a used Honda Odyssey in March 2013. Why why didn’t pay cash, here.

A note on the student loans: Joseph’s student loans continue to go down because the US Air Force JAG has been contributing a lump sum towards them every year. They also fall under the income based public service repayment program, which makes our payments for us (& at 10 years any remaining balance is forgiven).

A note on our 1st mortgage: Our original plan was to pay off the mortgage to our rental property as part of our debt snowball once we paid off everything else first. But since we refinanced to such a low interest rate, we concluded that for us, it really doesn’t make a whole lot of sense to throw extra payments to that loan. Instead, we can put that money into retirement or investment accounts that will make 5% or more (rather than the 3.3% in interest we would save from paying down the mortgage). We figure as long as our investments make more than 4% over the long term (which is on the conservative side), our money is better spent investing rather than paying down the mortgage, which will be paid off in 12.5 years anyway.

A note on credit cards: Fortunately, our credit cards fall under the SCRA (Servicemember Civil Relief Act), which means the credit card companies cannot charge us more than 6% interest for as long as we are active duty military. Half of the credit card debt has a 0% interest rate (holy heaven, you know we are thankful for that one!!) while the other half is at 4%. I’m not thrilled at paying any interest, but 0% & 4% is much better than the typical 13% or 17%.

Synopsis: the good, the bad, the ugly

So, there’s a lot to dissect here, probably more than I can reasonably do in one post. But let’s break it down by the good, the bad, & the ugly.

The Good

Every year our total debt has gone down. We’ve cut $78K of total debt since October 2012. This is good!

We paid off the auto loan, the 2nd mortgage, & the consolidation loan has been cut drastically.

This year, we also put $5500 into a traditional IRA for me–our first retirement account. Not much, but it’s a start.

The Bad

Our debts hasn’t gone down as much as we would have liked. We still have $34K of credit/consolidation loan to pay off.

Our original plan had been to have all loans except for the student loans & mortgage paid off by now. Originally we planned on paying more than $2000 a month toward debt, then as our pay increased, $2500, then $3000.

But the reality was, we weren’t factoring in all sorts of other expenses beyond just the very basics. (And you well know how I often got overzealous about severely cutting the grocery budget, which never worked beyond just a few weeks!!)

Also, you can’t see this based on just these numbers, but we have no savings (& nothing, aside from my IRA, for retirement–which has been deliberate as we’ve been paying off debts). Joseph & I realized that this is UNACCEPTABLE. Even though our income is steady, there is no excuse for us not to have at least one month’s income in savings (see YNAB rule #4).

The Ugly

The biggest thing is that our credit card debt has gone up from three years ago!

It went from $18K to $26K.

Yikes.

How could this be?!

Easy.

I wasn’t budgeting for “unexpected expenses”–things like rental property repairs, annual membership fees (Dropbox, Amazon Prime, membership to Botanical Gardens, Clearplay, etc.), broken appliances, car repairs & maintenance, as well as unrealistically under budgeting things like groceries, birthdays/gifts, Christmas, household expenses, & clothing.

This is where YNAB comes in. YNAB has really shown me the light on this issue.

YNAB teaches that you’ve got to be realistic about your expenditures & to budget for everything (especially those semi-annual or annual expenses–which I had been, at best, lazily doing), while realizing that those numbers can & will change (the reason for rule #3).

Just to give you an idea, here are some of our “unexpected” expenses from recent memory:

- Computer of 6 years died. Bought a replacement laptop ($900)

- Microwave, dishwasher, refrigerator, stove, & toilet for rental property all had to be replaced. ($2400)

- Our spare freezer of 5 years stopped working. Replaced. ($600)

- Had to buy 4 futons for our kids for our smaller space in Japan. ($200)

- Furniture for our home in Okinawa since most of ours was too bulky & beat up to bring ($600)

- Bought two used cars for our stay in Okinawa, since we couldn’t bring our Honda, which we sold ($3800)

- Snorkeling & sports equipment ($300) — an absolute necessity for anyone with 5 kids living next to a park & the beach 😉

- Key on piano broke. ($150 repair)

- Tune-up & other misc. car repairs on Honda that we have since sold ($2000)

In the next post, I want to share with you how we are going to move forward, how our approach to tackling debt has changed, a breakdown of our expenditures, & most importantly, why I am optimistic that the end is in the not too distant future.

Are you getting out of debt too? How have your expectations met with reality? Please share!

Other bring joy posts you might want to read:

Comments